← resting heart rate over time Resting nhs income tax rates over time Tax taxes income much pay average people do refund percent rates year system progressive paying results when rate chart each →

If you are searching about How Federal Income Tax Rates Work | Full Report | Tax Policy Center you've visit to the right web. We have 26 Images about How Federal Income Tax Rates Work | Full Report | Tax Policy Center like Data-Driven Viewpoints: A 99 YEAR HISTORY OF TAX RATES IN AMERICA, Federal Income Tax Data, 2021 Update | Tax Foundation and also THE HISTORY OF TAXES: Here's How High Today's Rates Really Are. Here you go:

How Federal Income Tax Rates Work | Full Report | Tax Policy Center

www.taxpolicycenter.org

www.taxpolicycenter.org

tax income rates federal top taxes rate history marginal brackets bracket graph inequality american policy center publications taxpolicycenter till

Which Matters Most - Tax Rates Or Tax Brackets? - Retirement Income

www.smartfinancialplanning.com

www.smartfinancialplanning.com

brackets taxes

Type Of Tax As A Share Of Federal Revenues, 1934 - 2018 | Tax Policy Center

www.taxpolicycenter.org

www.taxpolicycenter.org

tax federal revenues historical type share individual taxes statistics 1934

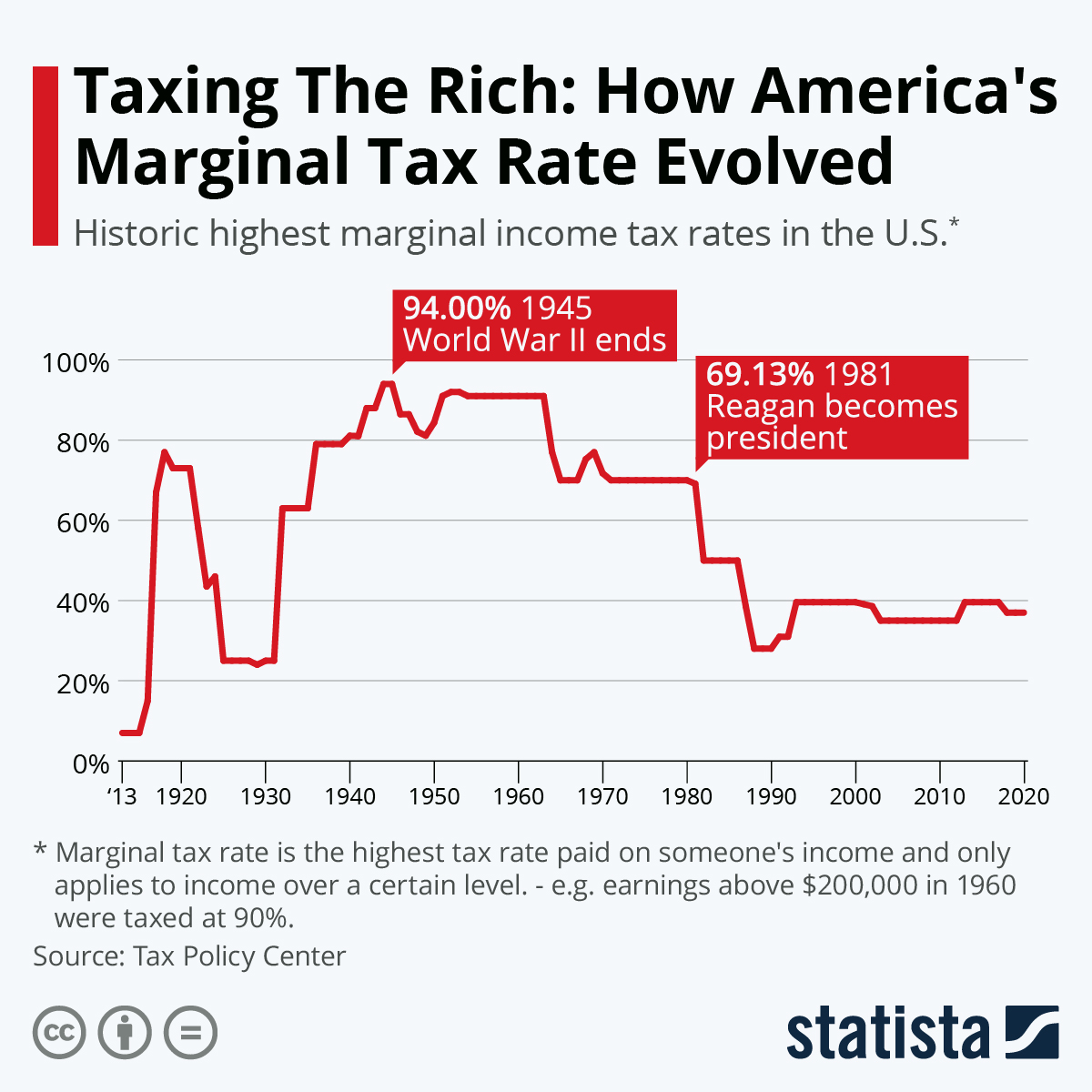

Chart: Taxing The Rich: How America's Marginal Tax Rate Evolved | Statista

www.statista.com

www.statista.com

marginal income taxing evolution statista evolved westend61

Federal Income Tax Data, 2021 Update | Tax Foundation

taxfoundation.org

taxfoundation.org

income paid taxpayers wealthy highest increased

Is The Current U.S. Income Tax System Fair And Sustainable

topforeignstocks.com

topforeignstocks.com

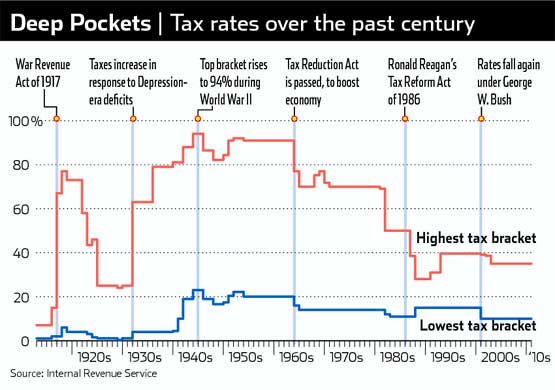

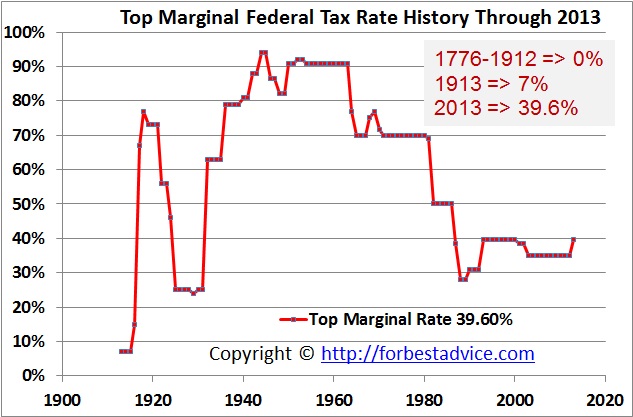

tax rates income taxes historical system history low year federal over time top street wall current two sustainable fair histories

Tax Tricks: Historical Tax Rates

tax-tricks.blogspot.com

tax-tricks.blogspot.com

tax rates historical rate income tricks bracket

세 종류의 소득(Income), 각 소득에 대한 택스는?

www.eunduk.com

www.eunduk.com

Blue-to-Red Migration, Part III: The Slow-Motion Suicide Of High-Tax

danieljmitchell.wordpress.com

danieljmitchell.wordpress.com

Income Tax Graph

ar.inspiredpencil.com

ar.inspiredpencil.com

"Most Progressive Tax Rates Since 1980" = BS - Democratic Underground

www.democraticunderground.com

www.democraticunderground.com

tax rates income marginal chart top corporate historical taxes history federal rate capital gains 1916 2010 since 2011 1980 rich

Chart Of The Day: Tax Rates On The Rich And The Rest Of Us – Mother Jones

www.motherjones.com

www.motherjones.com

taxes

How Do Federal Income Tax Rates Work? | Tax Policy Center

www.taxpolicycenter.org

www.taxpolicycenter.org

tax income federal rates do work taxable taxed rate current table tables progressive brackets

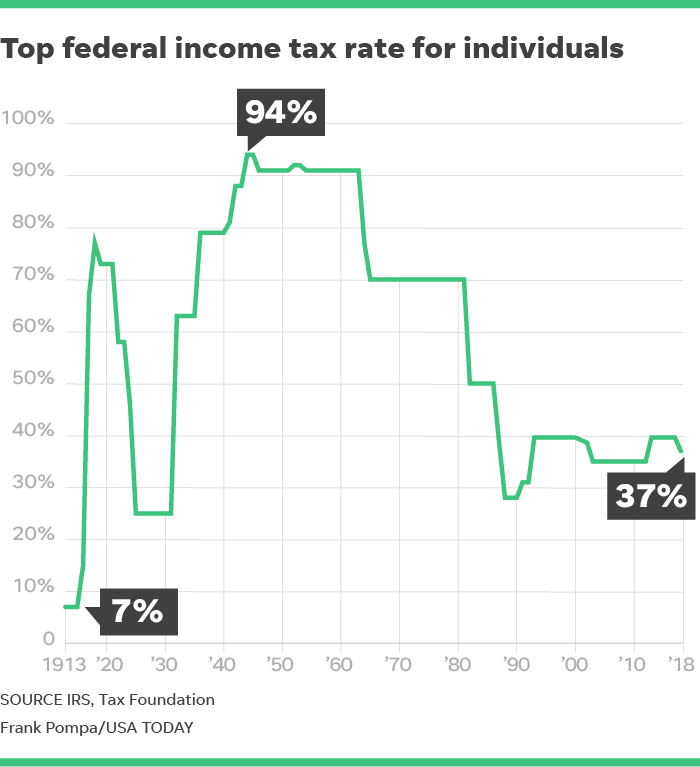

THE HISTORY OF TAXES: Here's How High Today's Rates Really Are

www.businessinsider.com

www.businessinsider.com

tax history rates taxes income bracket top rich 1913 federal low high now they brackets been highest today time america

How Federal Income Tax Rates Work | Full Report | Tax Policy Center

www.taxpolicycenter.org

www.taxpolicycenter.org

tax income federal rates work taxable tables table chart gross adjusted taxed progressive policy higher marginal

US Top Marginal Tax Rates - Data

forbestadvice.com

forbestadvice.com

Tax Policy – E Pluribus Unum – US

epluribusunum-us.com

epluribusunum-us.com

tax chart rates nyt 1913 historical policy source tag

Average Tax Rate Definition | TaxEDU | Tax Foundation

taxfoundation.org

taxfoundation.org

tax rate rates percent federal wealthy bracket

The Top 1 Percent’s Tax Rates Over Time | Tax Foundation

taxfoundation.org

taxfoundation.org

income marginal richest revenue

Data-Driven Viewpoints: A 99 YEAR HISTORY OF TAX RATES IN AMERICA

aseyeseesit.blogspot.com

aseyeseesit.blogspot.com

tax rates federal history year brackets america inflation adjusted income individual 1913 data 2011 than through covid expensive response operations

Income Tax 계산 방법(간편 계산기 포함)

www.eunduk.com

www.eunduk.com

Top Marginal Income, Corporate Tax Rates: 1916-2010 [CHART] | HuffPost

![Top Marginal Income, Corporate Tax Rates: 1916-2010 [CHART] | HuffPost](https://i.huffpost.com/gen/267149/MARGINAL-TAX-RATES.jpg) www.huffingtonpost.com

www.huffingtonpost.com

tax rates income marginal chart corporate top historical taxes rate history federal capital since gains president 1916 2010 rich 2011

Do The Wealthy Pay Their Share? – The American Catholic

www.the-american-catholic.com

www.the-american-catholic.com

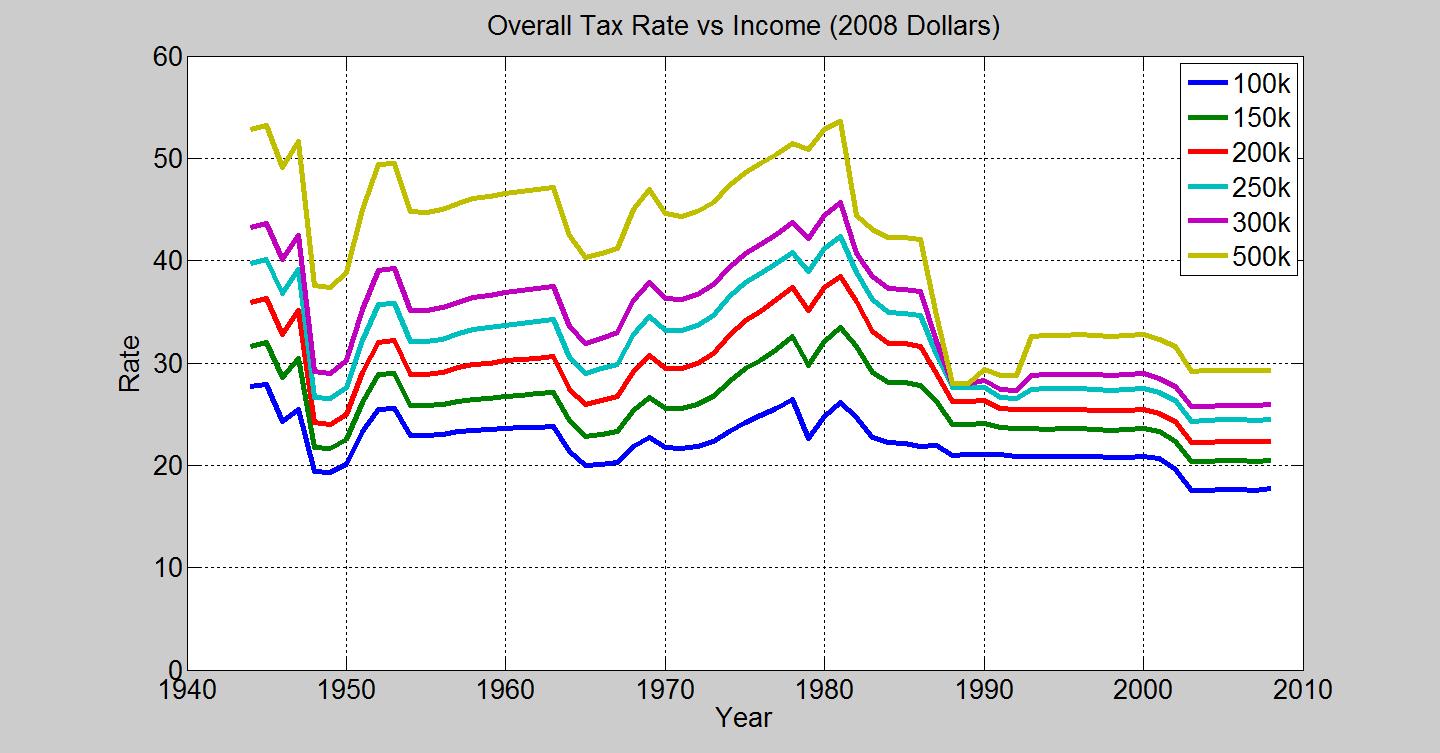

tax rates taxes top share revenues rate chart vs paid buffet wealthy pay do income revenue over marginal time 1980

Top 20 What Are The Federal Tax Brackets 2022

en.apacode.com

en.apacode.com

US Federal Tax Rates Over Time By Apps

hal9.com

hal9.com

Foolish Take: How Tax Rates On Rich Have Changed Over Time

www.publicopiniononline.com

www.publicopiniononline.com

taxes wealthy taxed foolish ira expats invest roth

Taxes wealthy taxed foolish ira expats invest roth. Tax rate rates percent federal wealthy bracket. Tax history rates taxes income bracket top rich 1913 federal low high now they brackets been highest today time america